Nippon Gases and Suma Capital sign strategic agreement to develop biomethane project

Nippon Gases, a European subsidiary of Nippon Sanso Holdings Corporation, a leader in the manufacturing, treating, and purifying of industrial and medical gases and Suma Capital, an independent investment manager pioneer in sustainable infrastructure investments, have signed a strategic agreement to develop biogas upgrading projects for biomethane production. The joint venture established for this alliance will be called Soluciones Totales de Biometano (STB).

Nippon Gases will contribute its expertise in gas treatment and purification technologies, as well as its experience in the operation and maintenance of gas production plants, while Suma Capital will bring its expertise as one of the most active financial investors in the development and construction of biogas and biomethane plants in Spain.

STB already has two pioneering projects in Spain with a combined production capacity of 52GWh of biomethane per year in the first phase and up to 82GWh in the second. The first project in Aragon will be Spain's first upgrading plant to produce liquefied biomethane (BioLNG) as a clean fuel for land transportation. Nippon Gases will be responsible for the construction and operation of the upgrading and liquefaction plant, and Naturgy will purchase the BioLNG produced through a long-term BioLNG purchase agreement. The second project, located in Cuenca, will have the unique feature of injecting biomethane directly into Enagás' gas transportation network. The planned investment for these two projects amounts to €10 million, and they are expected to be operational in the second half of 2024.

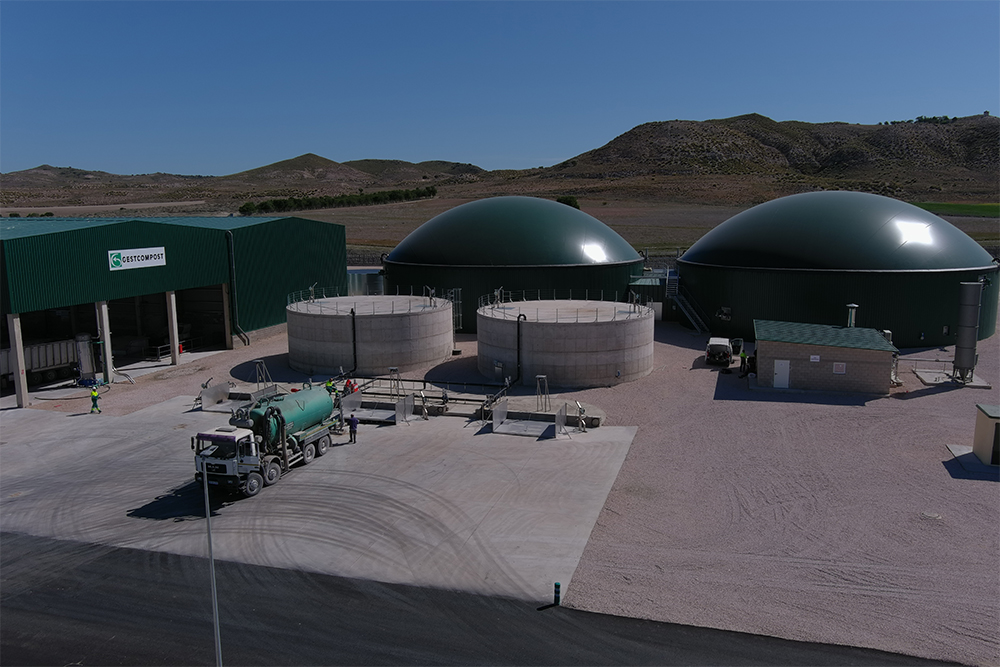

The biogas producer needed for BioLNG and biomethane production at both sites will be Gestcompost Group, a company in which Suma Capital is invested through its sustainable infrastructure fund. The Gestcompost Group, which has experienced a significant growth trajectory in Spain over the last three years, is one of the leading companies in Spain in the treatment, valorisation, and energy production from non-hazardous biodegradable organic waste, with a waste treatment capacity of 1,100,000 tons between the two facilities linked to these projects.

The biomethane projects promoted by STB play a crucial role in decarbonisation and the transition to a more sustainable economy. The biogas used in the upgrading process will be produced from organic waste, reducing the volume of waste in landfills and preventing methane emissions into the atmosphere. Furthermore, biomethane, which is biogas purified to natural gas quality, will enable its use as a clean fuel for applications requiring high energy quality, such as transportation and industry. The projects will promote local employment, the circular economy, and carbon footprint reduction.

"This strategic agreement with Suma Capital demonstrates Nippon Gases' commitment to the transition toward a more sustainable energy model. Thanks to this alliance, we will be able to apply our expertise in gas treatment and purification technologies to develop biomethane projects in Spain and contribute to the reduction of greenhouse gas emissions", said José Vicente Sánchez Navarro, Director of Marketing and Business Development at Nippon Gases Spain.

"This agreement with Nippon Gases allows us to expand our capacity to develop sustainable infrastructure projects in Spain and Europe. We believe that investment in biogas and biomethane has enormous potential to contribute to the energy transition and reduce greenhouse gas emissions", commented Pablo de Muller, founding partner of Suma Capital. Both companies will continue to explore new projects together through this strategic alliance.

About Suma Capital

Suma Capital is an independent alternative asset manager, a leader in energy transition and climate action. The firm focuses its investments on sustainability through three different programs: Sustainable Infrastructure, Growth Capital, and Venture Capital. Suma Capital was founded in 2007 and currently holds €800 million under management and has a presence in Barcelona, Madrid, and Paris. The Sustainable Infrastructure division is a pioneering initiative that has been supporting companies and projects that promote energy transition and the circular economy for the past ten years, with the goal of achieving both financial and socio-environmental returns.

https://sumacapital.com